Illinois slot machine revenue is a key element in the state’s economy, reflecting both the popularity of gaming and the fiscal policies surrounding it. This comprehensive analysis provides a deep dive into its impacts, trends, and future prospects.

Introduction to Illinois Slot Machine Revenue

While slot machines have long been a source of entertainment for gamblers, in Illinois they are more than just a game; they are a significant revenue source for local businesses, and with ramifications extending from broader local economies to the state’s financial infrastructure. Understanding the ins and outs of Illinois slot machine revenue requires a glance at its history, an evaluation of its economic impact, and a forecast of what the future holds for this gaming niche.

A Brief History of Slot Machines in Illinois

Illinois’ relationship with slot machines is storied and complex. From their early introduction in casinos to the expansion into local bars, taverns, restaurants, and gaming cafes, slot machines have become an integral part of Illinois’ entertainment landscape, generating billions in revenue annually. The evolution of legislation has continually shaped their presence, accessibility, and, by extension, the revenue generated from these popular gaming machines.

The Economic Impact of Slot Machines in Illinois

Slot revenue benefits local businesses by providing employment, increasing revenue for bars and restaurants, boosting tourism, and supporting various enterprises, while also contributing to state finances.

How Slot Revenue Benefits Local Businesses

Slot machines do more than provide a pastime; they spill benefits into local economies. From the direct employment, to added revenue for local bars and restaurants, to increased tourism, the ripple effect of slot gaming supports a myriad of businesses. Moreover, the revenue share contributes to local projects and infrastructural developments, boosting economic growth within various municipalities.

Supporting State Finances: Where the Revenue Goes

Illinois gaming revenue plays a significant role in state finances. The State’s portion of slot machine income is directed into Capital Projects, supporting state infrastructure and other public projects. The transparency in the allocation of these funds showcases the state’s commitment to leveraging gaming for the broader public good.

Understanding the Revenue Model of Illinois Slot Machines

The revenue model of Illinois slot machines is calculated to ensure profits are transparent for all parties involved–including players, terminal operators, local businesses and the state.

Payback Rates Explained

At the heart of slot machine revenue is the “payback rate” – a predefined percentage of wagered money that a machine returns to players over time. This rate, balanced with the volume of play, ultimately dictates the revenue generated, providing a predictable long-term model for both Operators and the state.

The Calculation of Slot Machine Revenue

Revenue from slot machines isn’t just a tally of cash inserted minus winnings paid out. It’s a complex algorithm involving payback rates, total bets placed, and, on the operator side, the operational expenditures of running these electronic gaming terminals. Understanding this calculation is crucial in analyzing the true economic imprint of Illinois’ slot gaming sector.

VGTs and the Mandated Split

When it comes to Video Gaming Terminals (VGTs) popular in bars, restaurants and gaming cafes, Illinois employs the “mandated split”. All revenue generated by VGTs is divided between the gaming business, the Terminal Operators, and the state and city. Split into thirds, these rates keep revenues transparent and competition honest.

Legislation and Slot Machine Revenue

The legal framework for Illinois slot machines is shaped by evolving legislation aimed at maximizing revenue, promoting responsible gaming, and encompassing recent changes.

Legal Framework Affecting Illinois Slot Machines

The legal tapestry governing slot machines in Illinois is intricate, influenced by years of legislative adjustments aimed at maximizing revenue while ensuring fair play and responsible gaming. These laws define everything from the operation of slots to the taxation structure applied to revenues, significantly impacting the state’s economic benefits from gaming.

Recent Legislative Changes and Their Impact

Legislative dynamism is part of Illinois’ slot machine narrative. Recent laws have altered the gaming landscape, with modifications in tax structures, betting limits, and the introduction of additional gaming positions in licensed establishments. These changes reflect the state’s adaptive strategies in managing gaming for economic gain while mitigating associated social risks.

Trends in Illinois Slot Machine Revenue

Analyzing slot machine revenue in Illinois reveals a dynamic history influenced by economic factors and technological changes, offering insights into the overall health of the industry.

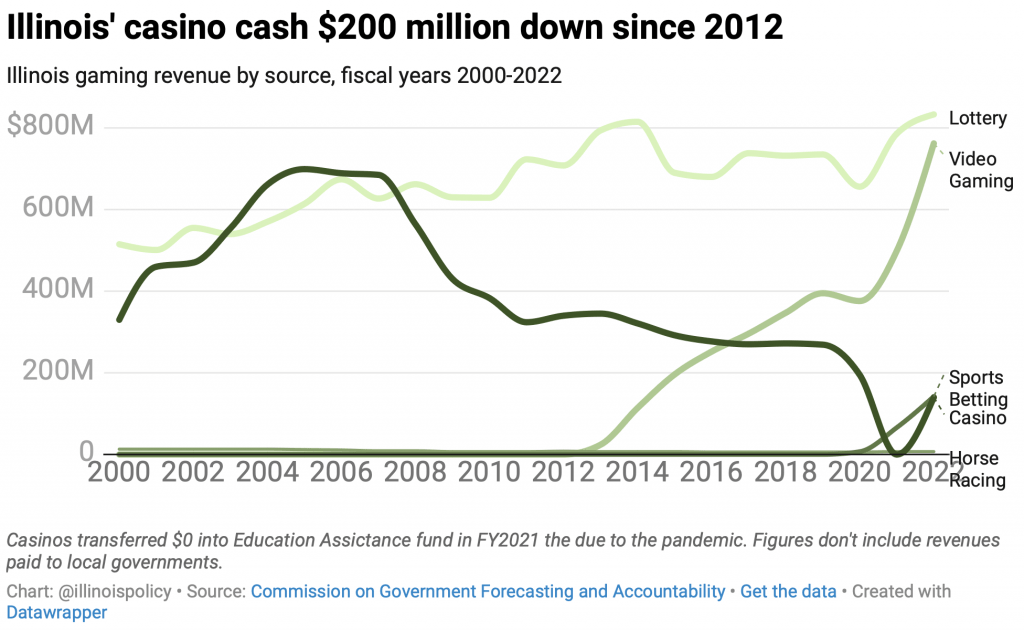

Analysis of Revenue Peaks and Troughs

Revenue trends from slot machines in Illinois present a fascinating chronicle of highs and lows, influenced by factors such as economic shifts, technological advancements, and changes in gambling preferences. Illinois gaming reports and historical analysis of gaming trends provides insights into the industry’s health and the potential factors driving revenue fluctuations.

Comparing Illinois’ Revenue with Other States

Positioning Illinois’ slot machine success story on the national stage involves comparing its revenue metrics with those of other states. This 2022 comparison from the American Gaming Association highlights the competitive nature of the gambling industry and how Illinois measures up in terms of regulatory frameworks, market size, and revenue generation.

The Future of Slot Machine Revenue in Illinois

Illinois’ future slot machine revenue growth is impacted by a variety of interlinking factors that is in a constant state of evolution.

Projected Revenue Growth

Forecasting the future of Illinois’ slot revenue involves examining current trends, legislative forecasts, and potential market expansions or contractions. While precise predictions are elusive, an educated projection based on existing data can provide valuable insights for stakeholders ranging from state planners to private investors.

Potential Market Factors Influencing Future Revenue

Several market factors could sway Illinois’ slot machine revenue in the coming years. These include the saturation of the gaming market, shifts in consumer preferences, technological innovations, the opening of new casinos, and potential legislative changes. Understanding these factors is essential for anyone invested in the future of Illinois’ gambling revenue landscape.

Technological Innovations in Illinois’ Slot Machines

From improving player experiences to enhancing security features, sophisticated software and technology is driving revenue growth in the Illinois slot machine industry.

How Modern Tech is Integrated into Slot Gaming

Technology is revolutionizing Illinois’ slot machines, from the integration of sophisticated software improving player experiences to enhanced security features safeguarding the integrity of the game. These technological strides are not just about flashy screens and interactive elements; they are pivotal in driving revenue by attracting a modern cohort of players and streamlining operations.

Tech Advancements and Revenue Correlation

The correlation between tech advancements and slot machine revenue in Illinois is undeniable. Enhanced gaming experiences drive increased patronage, while efficient machine management and security innovations ensure maximum revenue collection and compliance with regulatory standards. This synergy underscores the role of technology as a revenue booster in the slot machine business.

Societal Perspectives on Illinois Slot Machine Revenue

The dialogue on slot machine gaming in Illinois impacts legislative decisions and the industry’s revenue trajectory, as policymakers work to balance revenue generation with responsible gambling.

Public Opinion and Slot Machine Gambling

Public perception of slot machine gambling in Illinois is a mosaic of opinions, reflecting differing stances on its societal impact. While some laud the revenue benefits and entertainment value, others critique the potential for problem gambling. This dichotomy influences legislative actions and by extension, the revenue trajectory of the industry.

Responsible Gambling and Revenue Management

Balancing revenue generation with responsible gambling is a constant area of focus for Illinois policymakers. Initiatives aimed toward promoting responsible gambling are integral to sustaining the industry’s social license, ensuring that revenue generation doesn’t come at the cost of societal well-being.

Illinois Slot Machine Revenue: The Bigger Picture

Slot machine revenue contributes significantly to state finances, job creation, and local economies, serving as a potential model for other states in balancing economic optimization and social responsibility in the gaming industry.

The Role of Slot Revenue in Illinois’ Broader Economy

Slot machine revenue is a single, yet significant strand in the web of Illinois’ broader economy. It is a balancing act of generating income for state coffers, stimulating job creation, and supporting local economies while managing the associated risks. The state’s approach to handling this delicate equilibrium is a testament to its commitment to sustainable economic strategies.

Lessons from Illinois: A Model for Other States?

The Illinois model of slot machine revenue management offers both lessons and cautionary tales for other states. The strategic integration of slot machines into the broader gaming and entertainment industry, balanced with progressive legislation, presents a blueprint worth considering for regions keen on optimizing gambling’s economic potential while maintaining social responsibility.

FAQs about Illinois Slot Machine Revenue

What percentage of Illinois’ state revenue comes from slot machines?

Slot machines contribute a significant portion to Illinois’ state revenue, with the exact percentage varying from year to year based on factors like economic conditions, technological advancements, and legislative changes. Official state financial reports provide detailed breakdowns of these figures.

How are slot machine revenues in Illinois taxed?

Illinois imposes a flat tax structure on slot machine revenues, which means the tax rate is a fixed percentage of net revenue. This structure is detailed in the state’s gaming laws, ensuring a transparent and predictable taxation process.

Are there any recent laws affecting slot machine revenue in Illinois?

Yes, Illinois regularly reviews and updates its gaming laws at the state level, and municipalities frequently update their ordinances, impacting aspects like the number of authorized slot machines, operational hours, and tax rates. These changes aim to optimize revenue generation while upholding responsible gambling practices.

How does technology influence slot machine revenue in Illinois?

Technology plays a critical role in enhancing player experience, improving security, and introducing new games, all of which influence revenue. Innovations like digital platforms and advanced game features attract more patrons, thereby potentially increasing revenue.

Can slot machine revenue impact local economies in Illinois?

Absolutely. Local economies benefit through direct employment in gaming establishments, increased tourism, and the multiplier effect of slot machine revenue. Additionally, a portion of the tax revenue goes directly to communities, which supports projects and infrastructure.

Is there a responsible gambling initiative in Illinois?

Yes, Illinois is committed to promoting responsible gambling. The state collaborates with organizations to provide resources for problem gamblers, and it also enforces regulatory measures to ensure gambling providers adhere to responsible gaming practices.

Conclusion: The State of Slot Machine Revenue in Illinois

Illinois slot machine revenue is a dynamic component of the state’s economy, intricately tied to legislative movements, societal trends, and technological innovations. While it’s a robust source of income, the state’s challenge lies in harnessing this revenue source responsibly and sustainably. As we look to the future, the evolving landscape of slot machine gaming in Illinois will undoubtedly continue to be a fascinating study of economics, policy, and human behavior.